Physical Shares

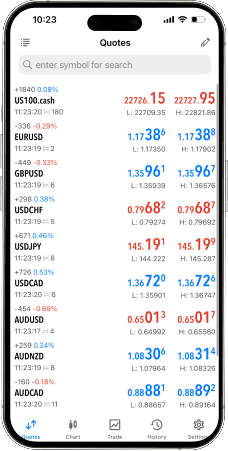

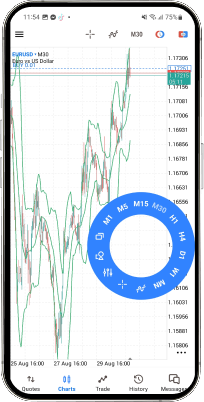

Instruments

Physical shares represent a stake in the ownership of a company. By investing in shares, you may have the right to participate in the company’s decision-making. Of course, everything depends on the size of the shareholding in the company you’ve invested in.

Trading is risky and your entire investment may be at risk.

Warning: Investago reserves the right to widen the spread at its sole discretion, reduce leverage, set a maximum order limit, and limit the client's overall exposure. InvestaGO also reserves the right to increase margin requirements in situations where market conditions require it. Please read the Trading Account Agreement carefully.

* Trading complex products with higher leverage involves a high level of risk and may lead to the loss of all or part of your invested capital.

** Right after you open your trading position, spread, which is the difference between the current ask and bid price, will be deducted from your account.

*** Minimum commission applies and it depends on your account's currency (20 EUR / 20 USD / 500 Kč / 6000 HUF / 80 PLN). Upon opening and closing a trading position, a commission will be deducted from your account.

**** The GAS pricing is based on HUB-NYMEX, Henry Hub Natural Gas (FFS Symbol: XNGUSD). The spot price is derived from a weighted average between the 1st and 2nd month futures contracts and follows the New York business day convention. For GAS, 1 unit equals 10,000 MMBtu (million British thermal units).

Frequently Asked Questions (FAQ)

It is completely normal that before you start investing with us, you want practical advice on how to open an account or whether we have offices in the selected country. We believe you will find all the answers you need in the text below.